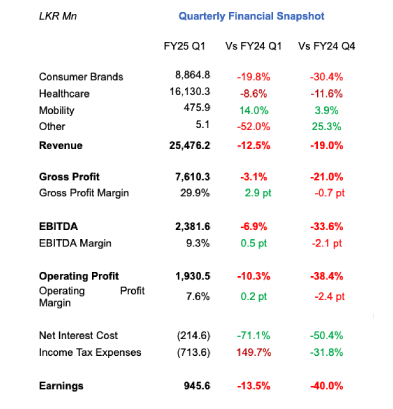

Hemas Holdings PLC achieved a cumulative revenue of Rs. 25.5 billion while delivering operating profits and earnings of Rs. 1.9 billion and Rs. 0.9 billion respectively. The decrease in revenue compared to last year was mainly influenced by several downward price adjustments and subdued consumer spending, intensified by extended holidays during the first two months of the quarter. Despite the revenue decline, the Group's profitability margins benefited from efficiency improvement initiatives and reduced finance costs.

Operating Environment

The positive economic trends observed in the previous quarter extended into this quarter, with the Gross Domestic Product (GDP) recording a growth of 5.3 percent. However, the exchange rate experienced some volatility resulting in the Sri Lankan Rupee (LKR) closing at 305.71 by the end of June 2024. The Average Weighted Prime Lending Rate (AWPLR) showcased a downward trajectory, settling at 8.78 per cent by quarter - end. This reduction eased the financial strain for numerous businesses and individuals.

The Colombo Consumer Price Index rose to 1.7 percent by the end of June 2024, primarily influenced by food inflation. Despite improved macroeconomic indicators, affordability continues to be a concerning issue for the public due to the already elevated cost of living and adverse impact of direct and indirect taxes. Consequently, consumption levels remain more subdued than anticipated.

Consumer Brands

During the quarter, market-wide price reductions were evident, driven by the strengthening of the domestic currency and decline in global commodity prices. However, there was a visible slowdown in consumer demand across general trade channels due to extended holidays during the first two months of the quarter. Consumer purchasing patterns continued to favour value-for-money offerings, reflecting the ongoing constraints on consumer purchasing power.

The Stationery market faced a slow down with prolonged school closures in the first quarter coupled with the gradual easing of increased seasonal stock holding from previous quarters. Further the market continues to face intense competition from new brands entering the market with the relaxation of import restrictions and appreciation of the rupee. Consumers continue to prioritise affordability and phase out buying patterns.

The Sector reported a revenue of Rs. 8.9 billion, with operating profits and earnings at Rs. 0.8 billion and Rs. 0.6 billion respectively. Despite the decline in revenue compared to the same period last year, strategic supply chain efficiencies coupled and productivity improvement initiatives resulted in margin enhancements for the businesses.

Home and Personal Care

During the quarter, the increased focus on personal care proved successful, particularly in key segments such as Baby and Feminine Hygiene, which continued to strengthen their market presence. In line with market dynamics, price revisions and promotions were implemented across the portfolio, notably in laundry and oral care. Despite subdued consumer demand, the core portfolio maintained robust performance while new product launches also gained positive momentum. Continuing the focus on consumer-driven innovations, this quarter saw the launch of Baby Cheramy Liquid Soap and the introduction of two new variants of Goya Soap, further enhancing our product offerings while ensuring a broader range of choices for our customers.

Learning Segment

‘Atlas’ maintained its market leadership in the mass market segment while also expanding its market share in both the premium

and value-for-money segments. Reinforcing the brand’s commitment of ‘making learning fun’, several efforts were undertaken

to establish a unique and innovative Point of Difference, positively contributing to the brand value and overall performance.

Consumer Brands International

The persistent high inflation in Bangladesh has prompted consumers to switch from Value-Added Hair Oil (VAHO) to Coconut Oil. Despite these challenging market conditions, ‘Kumarika’ increased its market share in the VAHO market. Recent introductions in the value-for-money and the pure coconut oil categories have also achieved significant traction in the market. ‘Actisef’ continues to play a crucial role in the product portfolio.

Healthcare

The Pharmaceutical industry continued to contract into the first quarter, although the rate of decline showed signs of easing. Economic pressures have led consumers to increasingly favour generics and lower-priced products. There are improvements in regulatory stability within bodies like the NMRA and MSD compared to previous quarters.

The Healthcare Sector posted a revenue of Rs. 16.0 billion, with operating profit and Earnings reaching Rs. 1.3 billion and Rs. 0.8 billion respectively. The focused effort on optimizing overheads and working capital accompanied by the decline in interest rates resulted in the increased profitability of the sector.

Pharmaceuticals

Amidst market contraction and regulatory price reductions, the Pharmaceutical Distribution Business sustained its market leading position for the quarter. Both the Distribution and Manufacturing businesses remained focused on optimising overhead costs, implementing efficiency improvement initiatives, and capitalising on synergies. These efforts, coupled with effective management of working capital, notably enhanced profitability. Additionally, the Distribution business expanded its portfolio by introducing 13 new products in the Rheumatology, Anti-Infective, and Neurology spaces.

Hospitals

With fewer communicable diseases were reported compared to the same period last year, hospital admissions have experienced a slight decline. In contrast, there has been an increase in both inpatient and outpatient volumes due to an increase in surgeries and medical screenings. Efficiency measures have successfully reduced administration costs compared to the previous year.

Amidst global challenges in the maritime sector, intensified by tensions in the Red Sea and anticipated tariff hikes on Chinese goods, the Port of Colombo encountered congestion while the throughput growth to two percent for the quarter. The rise in freight rates along with increase in volume bolstered the Maritime segment's performance compared to the same period last year.

Conversely, the Aviation sector saw a positive impact on cargo volumes, as increased tonnage was diverted to mitigate port congestion. In the passenger segment, high competition among industry players affected overall volumes. Nonetheless, the Aviation vertical overall benefited from improved yield and higher cargo volumes.

During the quarter, the Sector posted a revenue of Rs. 475.9 million, an increase of 14 percent mainly due to volume-led growth in the maritime sector. Consequently, the operating profit and earning posted over 100 percent growth to reach Rs. 455.3 million and Rs. 269.7 million respectively.

Continuing focus on ESG

During the quarter, the Group continued its work on the Environmental Agenda, focusing on offsetting plastic waste, reducing water usage in operations, and increasing the use of renewable energy in its operations. The Group water intensity per rupee million revenue per m³ remained at 1.6. At present Hemas House, Learning Segment Manufacturing Facility, and Pharmaceutical Manufacturing Facility have shifted to utilising renewable energy through rooftop solar which resulted the Group’s use of renewable energy increasing by 404.1 percent to 12.1 percent, compared to Q1 of FY24. Home and Personal Care Manufacturing Plant in Dankotuwa will be commencing the use of renewable energy during the fourth quarter of FY 25. These efforts are part of the Group’s commitment to ensuring that 25 percent of its energy consumption comes from renewable sources by 2030. Addressing plastic pollution remains a critical focus for the Group; the Learning Segment's partnership with Eco Spindles is a significant milestone in the Group’s efforts to collect and responsibly dispose of plastic waste. As the Group continues to work towards its goal of offsetting its plastic waste by 100 percent in 2030, to date, over 720,000 kg of plastic has been collected through initiatives conducted by the Group businesses. The Group's commitment to empowering families continued through its social initiatives, positively impacting over 56,800 families during the quarter. The Learning Segment collaborated with the Ministry of Education to enhance the Sri Lankan education system by providing professional training for educators specializing in early childhood development, preparing the youth of Sri Lanka for the future. The Group’s dedication to ensuring no child is left behind resulted in the opening of the 66th Piyawara preschool, benefiting 40 children from the underserved community in Akurana Dunuwila.

Outlook

While the broader economy of Sri Lanka has shown signs of recovery, consumer disposable income remains constrained by inflationary pressures and recent tax reforms. Anchored by its purpose, Hemas remains mindful of the changing dynamics of the external environment and is confident in its ability to navigate these headwinds. Looking ahead, the Group remains committed to its growth trajectory that focuses on expanding its footprint in the domestic and global arena. Hemas will continue to execute its strategic priorities outlined in its Long-Range plan while maintaining a strong focus on liquidity, efficient resource allocation and driving operational transformation across all business segments. Ravi Jayasekera

GActing Chief Executive Officer

July 30, 2024

Colombo