Performance review for the Six Months ended 30th September 2025

Overview

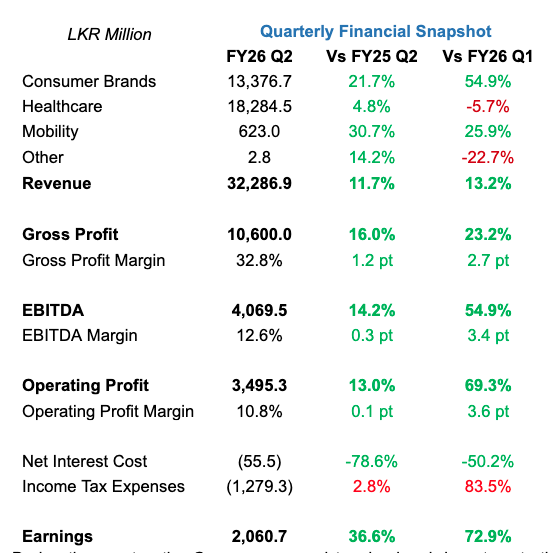

Recording yet another strong quarterly performance, the Group’s earnings rose by 36.6% to Rs. 2.1 billion compared to the corresponding quarter of the previous year, driven by robust revenue growth across all its business sectors. This growth in revenue, together with sustained operating margins, contributed to a 13.0% increase operating profit which grew to Rs. 3.5 billion. Further, net interest cost decreased by 78.9% during the quarter benefitting from reduced interest rates and lower borrowings.

Revenue for the first half of the year increased to Rs. 60.8 billion, while operating profit stood at Rs. 5.6 billion, reflecting a growth of 11.8% and 10.7% respectively, leading to cumulative earnings for the first half reaching Rs. 3.3 billion – an increase of 32.5%.

During the quarter, the Group announced two landmark investments that underscore the Group’s strategic agenda. Pursuing the Group’s international expansion strategy, Hemas entered into a Conditional Share Sale and Purchase Agreement to acquire a leading consumer products company based in Kenya.

In line with its long-term vision to evolve from a strong secondary care provider into one of Sri Lanka’s leading tertiary healthcare institutions, Hemas Hospitals commenced the expansion of its Thalawathugoda facility during the quarter. This strategic investment will increase bed capacity and introduce specialised services in cardiology, neurology, and nephrology, strengthening the hospital’s clinical capabilities and positioning it to meet the growing demand for advanced medical care in the country.

Reflecting strong investor confidence, the Hemas share gained 110.6% year-on-year, significantly outperforming the CSE All Share Price Index (ASPI) and the S&P SL20 Index which increased by 83.6% and 77.1%, respectively during the period.

Operating Environment

Sri Lanka’s sovereign debt restructuring process continued to make progress, with the country signing a bilateral debt restructuring agreement with the United Kingdom, marking another step toward restoring debt sustainability and reinforcing macroeconomic stability. In parallel, the International Monetary Fund (IMF) reached a staff-level agreement with the Government of Sri Lanka on the fifth review of the Extended Fund Facility (EFF) programme.

The Rupee maintained its stability against the US Dollar, depreciating marginally by 0.9% during the quarter to Rs. 302.61. The Central Bank of Sri Lanka held its benchmark interest rate at 7.75% during its September 2025 policy meeting, with the objective of guiding inflation toward the 5% target while sustaining the ongoing economic recovery. The Average Weighted Prime Lending Rate (AWPLR) declined from 8.11% to 8.05% during the quarter, contributing to a reduction in finance costs across the Group’s businesses. Headline inflation (CCPI YoY) turned positive during the quarter, recording 1.5% in September 2025. This shift from deflation to mild inflation reflects a recovery in domestic demand spurred on by increasing consumer confidence, following a period of contraction observed since September 2024. Sri Lanka’s labour market continued to strengthen, with the unemployment rate declining to 3.8% in the second quarter of 2025. Further, crude oil prices continued to ease, supporting lower import costs and contributing to stable domestic energy prices.

Signalling continued confidence in the country’s reform trajectory and its economic outlook, S&P Global Ratings upgraded Sri Lanka’s foreign currency sovereign credit ratings to ‘CCC+/C’ from ‘SD/SD’ (selective default) and affirmed the ‘CCC+/C’ local currency ratings.

Consumer Brands

Amidst improving consumer sentiment, the sector recorded healthy volume growth across all its segments. The uptick in sales, was further supported by increased marketing efforts, targeted promotional campaigns, and sustained brand-building initiatives.

Hemas Consumer Brands (HCB) has partnered with the University of Sri Jayewardenepura and the Department of Technical Education and Training (DTET), offering students practical experience, mentoring, and professional development opportunities.

The Consumer Brands Sector reported a robust performance, with cumulative earnings rising by 25.7% to 2.3 billion. Revenue increased by 10.9% to Rs. 22.0 billion while operating profit also improved by 15.1% to reach Rs. 2.9 billion.

For the quarter, the Sector reported a revenue of Rs. 13.4 billion, posting a growth of 21.7%, while the operating profits and earnings increased to Rs. 2.1 billion and Rs. 1.6 billion respectively.

Home and Personal Care – Sri Lanka

The sector maintained its recovery during the quarter, driven by the Beauty & Personal Care segments, which reported positive volume growth. During the quarter, the Company expanded its personal care portfolio with the launch of a novel charcoal-infused toothbrush under the Clogard brand.

Hemas Consumer Brands was recognised at the SLIM Digis Awards 2025, securing multiple accolades across several key brands and campaigns, including wining the Silver Award for Best use of AI technologies.

Consumer Brands International

Despite the macroeconomic challenges experienced in Bangladesh arising from inflationary pressures, political uncertainties and the country’s exports to the United States being subjected to reciprocal tariffs, the segment saw revenue growth as a result of better sales mix and volume growth in the Value Added Hair Oil (VAHO) category.

Learning

Atlas sustained its market leadership during the quarter, achieving a notable increase in revenues driven by volume growth. As part of the ongoing efforts to diversify its product portfolio, Atlas introduced the “Active Fit” range of school bags, designed to promote healthy posture and enhanced comfort for schoolchildren.

The business advanced its presence in the e-learning space through a strategic partnership to develop an innovative digital learning solution designed to enhance students’ academic performance and overall learning experience, reinforcing its commitment to strengthening the national education ecosystem through innovation and improved accessibility.

Atlas consolidated its position as a leader in technology-driven educational solutions by earning multiple accolades at the SLIM Digis Awards 2025, including the Silver Award for Best Use of Experiential/Immersive Marketing.

Healthcare

The cumulative sector revenue increased by 12.2% to Rs. 37.7 billion, with operating profits of Rs 3.1 billion and earnings of Rs. 2.1 billion, highlighting a growth of 10.3% and 15.3% respectively.

The Sector posted a revenue of Rs. 18.3 billion for the quarter, with operating profits of Rs. 1.5 billion and earnings of Rs. 1.0 billion.

The SLIIT–Hemas Allied Health Institute broadened its academic portfolio in the fields of Nursing and Psychology with the introduction of Biomedical Sciences as a new discipline. Following two successful intakes in July and October 2025, the Institute is strengthening its position as a premier centre for allied health education in the country, aligned with the growing demand for skilled healthcare professionals.

Pharmaceuticals

The Pharmaceutical Distribution business sustained its upward momentum through year-on-year volume growth. Broadening its presence in the consumer healthcare space, Morison expanded its product portfolio with the launch of two new offerings, ChlorMor, a paediatric formulation developed for the treatment of coughs and colds, and CeeMor Vitamin C Tablets, introduced for general wellness.

Hospitals

The Hospital segment recorded strong revenue growth during the quarter, driven by the expansion of service offerings across both hospitals. Medical admissions and channelling consultations saw a notable increase, partly reflecting the higher incidence of communicable diseases such as dengue and chikungunya. All business segments, including Home Care and the Outer Labs network contributed positively to the overall performance, underscoring the segment’s strengthened operational momentum and growing demand for its healthcare services.

Mobility

The Maritime segment recorded higher volumes during the quarter, supported in part by the introduction of the China–India Express service, which established direct connectivity between key ports in China and the Indian subcontinent. This development strengthened the segment’s network reach and enhanced its capacity to serve growing regional trade flows.

Led by growth in general and trans-shipment cargo, the Aviation segment saw its cargo volumes increasing during the period. Supported by increased frequencies, the passenger numbers also increased during the period. While the crude oil prices are expected to stabilise, which will help to contain operating costs and surcharge fees, the termination of the de minimis rule by United States (US), combined with a 50% reciprocal tariff increase on cargo exported from India to the US, is likely to impact demand and air cargo rates for this route.

The Sector achieved a cumulative revenue of Rs. 1,117.9 million, reflecting a growth of 18.7% while the earnings were reported at Rs. 396.3 million. The quarterly revenue and earnings increased to Rs. 623.0 million and Rs.248.0 million respectively.

Sustainability

The Group continued to advance its environmental and social priorities in line with the Group’s long-term sustainability strategy. Cumulative plastic recovered reached 2.1 million kilograms, reaffirming the Group goal of collecting 50% of the plastic sent to market by 2025 and 100% by 2030. The Pharmaceutical Manufacturing business further strengthened its contribution through a partnership with Eco Spindles to establish a collection facility targeting the recovery of over 5,500 kilograms of waste each month.

Water intensity rose marginally from 1.5 to 1.6, though efficiency initiatives remain underway across operations. Progress on renewable energy adoption continued, with 10.8% of total electricity consumption now sourced from renewables.

The Group continued to deliver meaningful impact across education, health, and inclusion, reaching over 35,800 families during the quarter.

Fems in partnership with the Ministries of Health and Education and the Sri Lanka Red Cross Society launched “Api Katha Karamu” (Let’s Talk), Sri Lanka’s largest menstrual health education initiative reaching over 180,000 students across nine provinces.

The Hemas Outreach Foundation opened its first Piyawara preschool in the plantation sector in Nuwara Eliya, expanding the network to 71 and improving access to early learning in underserved communities.

Outlook

While the country’s debt restructuring process is progressing well and early signs of economic recovery emerging, maintaining fiscal discipline and deepening reforms will be critical to transforming the current short-term rebound into sustained long-term stability, particularly given the persistent global financial risks and uncertainties.

The acquisition in Kenya announced during the quarter, is expected to be completed by the end of the current financial year, conditional upon obtaining regulatory approvals from both the Central Bank of Sri Lanka and the Competition Authority of Kenya, together with the completion of other conditions precedent.

The ongoing strategic review of the Long Range Plan (LRP), is designed to align the Group’s priorities with evolving market dynamics and emerging growth opportunities. In parallel, the Group continues to pursue cost optimisation and operational excellence through process enhancements, digital transformation, and innovation-led initiatives, while actively exploring investment opportunities in related and adjacent spaces to strengthen resilience and enhance long-term shareholder value.

Ashish Chandra

Group Chief Executive Officer

November 07, 2025

Colombo