Financial and Operational Review

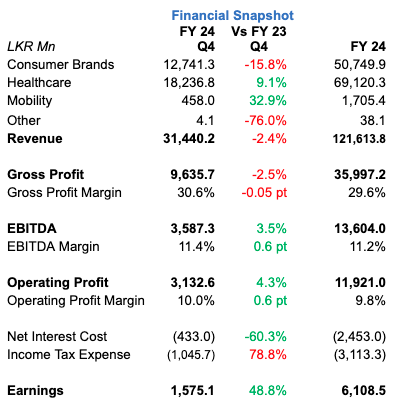

Amidst an improving macroeconomic landscape, Hemas Holdings PLC delivered robust results for the financial year 2023/24 to report a cumulative revenue of Rs. 121.6 billion, marking a 6.7 percent increase over last year. Driven by strong performance of the core businesses and reduced finance costs, the earnings demonstrated a significant 43.1 percent growth, reaching Rs. 6.1 billion, the highest ever earnings reported by the Group in a single year.

The Group reported a marginal decline in revenue for the quarter mainly due to the change in seasonality of the Learning Segment, resulting in a timing difference in the Consumer Sector. Despite the decline in revenue,

the positive impact of efficiency improvement initiatives resulted in operating profit to increase by 4.3 percent while the earnings improved by 48.8 percent to reach Rs. 1.6 billion.

The resilient performance of the core operations, coupled with successful initiatives aimed at optimising working capital, led to a significant improvement of Rs. 23.2 billion in operating cash flow compared to the financial year 2022/23. Additionally, the transition from a Net Debt position to a Net Cash position resulted in a net gearing ratio of minus 1.2 percent. The Group's “AAA (lka)-Outlook Stable” rating was reaffirmed by Fitch for the fifth consecutive year, serving as testament to the robust cash flows and strong balance sheet.

Operating Environment

Improvements witnessed in the macro economy towards the latter part of 2023 continued to 2024 with Gross Domestic Product (GDP) in the fourth quarter posting a growth of 4.5 percent. There was some volatility in the exchange rate during the quarter, with the LKR gradually appreciating towards the latter months and closing at Rs.301.18 per dollar by the end of March 2024. Average Weighted Prime Lending Rate (AWPLR) reduced by over 10 percentage points to close at 11.11 percent by the end of the quarter, easing the financial burden on many companies and individuals.

The Colombo Consumer Price Index eased to 0.9 percent by the end of March 2024, mainly due to reductions in the energy and commodity prices and positive impact of LKR appreciation and lower borrowing costs. However, the improved macroeconomic performances were not fully translated into household income as anticipated due to already elevated cost of living, and adverse impact of direct and indirect taxes. There were encouraging signs of growing consumer confidence observed in the latter part of the quarter, which may potentially be an indicator for market recovery.

Consumer Brands

Consumer dynamics witnessed signs of recovery during the quarter with both modern and general trade channels witnessing growth. This was further fuelled by the successful harvesting season, which had a positive ripple effect on the overall economy. However, the shifts witnessed in consumer buying patterns in the value-for-money segments continue to prevail amidst contracted purchasing power of the consumers.

The Learning Segment witnessed a slow down as the increased seasonal stock holding, which occurred in the preceding quarter, gradually eased during the quarter. Regional pockets and niche markets continue to observe fierce competition in the value-for-money segment. Affordability driven buying patterns such as delayed and partial fulfilment of the booklists, resulted in a lower offtake in the overall industry.

The cumulative revenue for the Sector posted a growth of 6.6 percent to reach Rs. 50.7 billion while the operating profit of Rs. 7.6 billion reported a growth of 28.9 percent. Despite the modest growth in revenue, multiple efficiency improvement initiatives and productivity enhancement measures coupled with supply chain efficiencies resulted in margin improvements for the businesses. Over 50 percent reduction in finance cost, lower working capital base and reduced cost of borrowing coupled with improved operating profit resulted in the earnings growing by 56.2 percent reaching Rs. 5.1 billion for the year.

During the quarter, the Sector witnessed a contraction of 15.8 percent in revenue due to the shift in back-to-school season from fourth quarter to third quarter. In line with the revenue decline, the operating profit of Rs. 1.8 billion witnessed a 15.1 percent degrowth, while the earnings witnessed a 27.2 percent contraction to reach Rs. 1.0 billion in comparison to Rs.1.4 billion witnessed last year.

Home and Personal Care

The Home and Personal Care Business posted a volume-led growth with improved market share in many key categories specially in the key focus segment: Personal care. While the core portfolio continued to deliver robust results, the business launched multiple New Product Developments (NPDs) across the portfolio including ‘Velvet Naturals’, ‘Fems Ultra-Thin’ and ‘Clogard Pro Clean’. The key focused segments Baby, Beauty and Feminine Hygiene continue to gain traction in the market. Despite the Value Added Tax (VAT) increases, the business made a cautious decision to absorb the adverse impact through positive impact of currency appreciation and cost savings.

Learning Segment

The Learning Segment of the Group improved its market leading position with the increase in market share in all three segments: premium, mass and value-for-money. ‘Atlas World’, the integrated platform for the Atlas Axillia community including ‘Atlas My Shop’ and ‘Atlas Learn’ successfully increased the of number engagements resulting in improved customer experience for direct-to-customers.

Consumer Brands International

Amidst the adverse macro-economic landscape, the Value-Added Hair Oil (VAHO) market in Bangladesh continued its declining momentum. However, with the collective success of the ‘Actisef’ brand, the newly launched coconut oil variant ‘Kolombo’ and the onion based ‘Eva’ hair oil, the Bangladesh business reported a volume growth and an NPD contribution to the business of over 25 percent.

Focus on expanding the international footprint remains in place, and multiple strategic initiatives were undertaken in key interest markets such as East Africa, Middle East, Pakistan and Bangladesh.

Healthcare

Despite some strides made in addressing drug shortages, the persistent shortage of healthcare professionals remains a significant concern nationwide. Towards the latter part of the quarter, changes were made to the leadership of the regulatory body, providing stability to the industry. Efforts have also been made to address procurement delays, further improving the situation within the state healthcare system.

The Healthcare Sector reported a revenue of Rs. 69.1 billion, a growth of 6.9 percent while the operating profit for the period witnessed a decline of 7.6 percent against last year due to increase in overheads, inventory provisions and one-off stock adjustments attributable to price revisions for regulated medicines. Despite the contraction in operating profit, the earnings for the year Rs. 2.3 billion, posted a growth of 12.3 percent due to reduction in finance costs and lower taxes.

During the quarter, Healthcare Sector revenue increased by 9.1 percent, to close at Rs.18.2 billion mainly due to the improved contribution from the Pharmaceutical Manufacturing segment. The growth was driven by the notable growth in Morison branded portfolio and Government orders. The increase in revenue was not translated to operating profits mainly due to adjustments made to the inventory provisions related to slow moving items in the Pharmaceutical Segment.

While the operating profit contracted by 21.9 percent, lower finance costs and positive deferred tax position resulted an increase in earnings by over 100 percent to reach Rs. 573.3 million.

Pharmaceuticals

Despite the market contraction and the challenges surrounding price reductions, the Pharmaceutical Distribution Business maintained its market leading position to post volume growth for the year. The strategic focus on improving the working capital position resulted in significant optimisation in the working capital of the business, positively impacting the profitability through reduced finance costs. The business extended its portfolio by introducing over 40 new products during the quarter into the market mainly in critical NCD spaces.

The industry wide challenges observed in the Pharmaceutical Manufacturing business during the preceding quarter, characterised procurement delays in the state sector, were notably subdued towards the latter part of the year resulting in a significant revenue growth. The branded generics portfolio continued to witness double-digit growth with its staple, ‘Empamor’ the Empagliflozin tablet ending the year as the market leader in volume terms.

Hospitals

Collective impact of improved total admissions and theatre utilisation coupled with increase in revenue from the laboratory chain resulted in a double-digit revenue growth in the Hospitals Business. Price adjustments were made in line with the industry to compensate for the inflationary pressure in overhead costs. Key specialties witnessed admission-led growth during the year contributing positively to the margin improvements. New initiatives including Ambulatory Surgical Care and Home Care services continued to gain traction in the market.

Mobility

Despite the challenges witnessed in the global maritime space, the Port of Colombo (POC) witnessed a growth in transshipment volumes and total throughput volumes of over 10 percent for the year, partially due to vessels rerouting via POC amidst tensions in the Red Sea. While import volumes have witnessed a robust growth with relaxation in Government restrictions, exports segment also witnessed significant improvements driven by an increase in volumes to key destinations in Europe. The passenger arm drove the Aviation Segment performance amidst increased tourist arrivals and outbound traffic.

The Mobility Sector witnessed a cumulative revenue growth of 3.9 percent to reach Rs. 1.7 billion, while operating profit and earnings reported an approximate degrowth of 20 percent mainly due to appreciation of the LKR.

During the quarter, the Sector posted a revenue of Rs. 458.0 million, an increase of 32.9 percent mainly due to volume-led growth in the maritime sector. Consequently, the operating profit and earning posted over 60 percent growth to reach Rs. 351.5 million and Rs.185.3 million respectively.

Leading with ESG

During the quarter, the Group remained steadfast in its commitment to its purpose of empowering families to aspire for a better tomorrow through impactful initiatives and interventions. World Down Syndrome Day was commemorated with a profound message of inclusion and empowerment, as the Hemas Outreach Foundation, through its 'Eka Se Salakamu' movement, championed the cause of individuals and families affected by Down syndrome, fostering a community where dignity and support prevail. Meanwhile, Morison's ‘Ape Suwadeya’ initiative marked its one-year milestone by extending invaluable healthcare support to over 250 team members and their families, exemplifying the Group’s dedication to employee well-being and access to essential medicines.

Additionally, the Pharmaceutical Manufacturing business partnered with the Sri Lanka College of Endocrinologists to address a prevalent health challenge in society. The launch of the certificate training program for primary healthcare professionals on diabetes management is a significant step towards enhancing healthcare infrastructure and expertise in Sri Lanka. As the country grapples with a rising diabetes epidemic, empowering primary healthcare providers with specialised knowledge ensures early intervention, effective management, and ultimately, improved health outcomes for the communities.

Homerun, Sri Lanka's beloved stationery brand, in partnership with the Ministry of Women and Child Affairs, is pioneering women's empowerment with the ‘Mav Diriya’ initiative. This programme addresses the challenges faced by underprivileged mothers, particularly those exacerbated by the pandemic and economic hardship. ‘Mav Diriya’ provides comprehensive training, support, and seed capital to enable mothers to establish home-based businesses and aims to empower 2,500 mothers by 2030. By fostering financial independence, ‘Mav Diriya’ strives to keep children in school and ensure families can thrive

In addition, the Group continued to address the needs of communities and create a security net through dry ration donations, meal pack distribution, and ensuring access to essential medicine, supporting over 59,400 families across the island.

Outlook

The Group maintains a cautiously optimistic stance regarding the macroeconomic outlook and recognises the critical importance of successful restructuring of the debt and adhering to the IMF programme to achieve macroeconomic stability. The country has witnessed several leading indicators suggesting a potential economic upturn, notably with an increase in demand. The Group is well-positioned to leverage such shifts by implementing consumer and patient centric approaches.

The Group will continue to invest in its core portfolio, striving for volume-led market share gains, while simultaneously exploring opportunities for both organic and inorganic growth within the broader Consumer and Healthcare Spaces. The strong financial position and liquidity provide a solid foundation for effectively leveraging financial resources to fuel these growth initiatives. Investing in underpenetrated segments and driving internationalisation will be the key priorities for the Consumer Sector. Simultaneously, the Healthcare Sector will concentrate on developing a branded generics portfolio under the brand Morison, driving distribution capabilities, expanding in key anchor specialties, and investing in the transition to a fully-fledged tertiary hospital. Improving the digital infrastructure and fostering a culture of data-driven decision-making will be a priority for all businesses as the Group continues its 75-year-long journey in empowering lives through innovative solutions for the future.

Ravi Jayasekera

Acting Chief Executive Officer

May 22, 2024

Colombo